Lemmy Shitpost

Welcome to Lemmy Shitpost. Here you can shitpost to your hearts content.

Anything and everything goes. Memes, Jokes, Vents and Banter. Though we still have to comply with lemmy.world instance rules. So behave!

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means:

-No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

If you see content that is a breach of the rules, please flag and report the comment and a moderator will take action where they can.

Also check out:

Partnered Communities:

1.Memes

10.LinuxMemes (Linux themed memes)

Reach out to

All communities included on the sidebar are to be made in compliance with the instance rules. Striker

view the rest of the comments

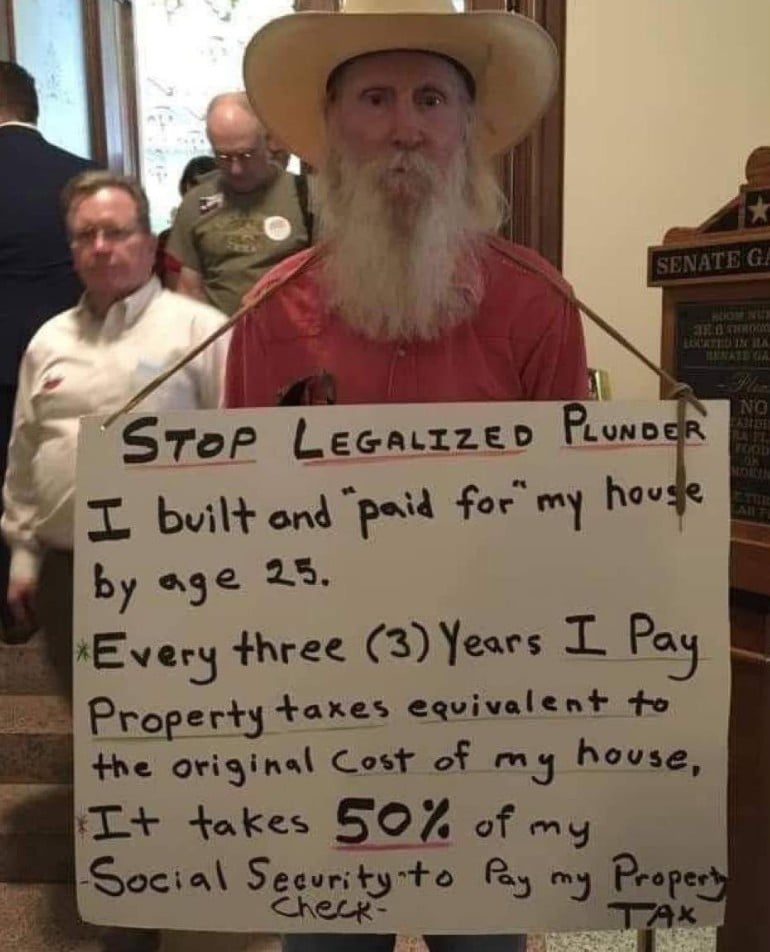

Using retirees as a tool to work against property taxes has historically been an effective strategy, but it's important to remember:

One-by-one:

What we're actually trying to accomplish

Seems to me that the root question is one of housing affordability, in particular for retirees, who may have a lot of assets, but limited cash flow

Will the proposed change be effective in accomplishing the goal

Reducing/capping property taxes does indeed make it easier for some retirees to keep affording their homes, but reducing property taxes makes real estate a more lucrative investment, driving up the overall prices of real estate. This applies for both private persons intending to use the property to live in, for private persons looking seek rent, and corporate actors doing the same. Messing with property taxes is a large part of the housing affordability issue present in many places in the U.S and elsewhere (zoning laws being another major contributor, in particular those mandating single family homes, and lack of public housing being the other major contributor). Hence, this change would only benefit those lucky enough to have purchased a home in the past, at the expense of all retirees not already that lucky, which are now less likely to be able to do so.

Will the change have other consequences that are negative to the extent where the potential benefits outweigh the consequences in aggregate

Apart from driving up the prices of real estate for other retirees, everyone else interested in purchasing a home will also feel this broad increase in prices. This has led to large swaths of the population being effectively priced out of home ownership. This has the second order effect of making owning rentals more lucrative, as higher rents can be charged, further exacerbating the larger problem of housing affordability, but now also for even poorer people.

Finally, reductions in real estate taxes limit what public services can be funded through their use. In the U.S, this primarily means schools, infrastructure, firefighting, transit etc, all of which are suffering a lot in quality, much as a consequence of having messed with property taxes in the past.

There's a very, very strong case to be made that the consequences have very much outweighed the benefits in this scenario. I would even say that they have been devastating, being part of the root cause of a large amount of issues seen today.

Are there any alternative means to accomplish the original goal

There clearly are good means to tackle this problem in other ways, the principal of which I believe should be massive public investment in social housing. By building a huge supply of high quality homes affordable to everyone, we make sure no one will have to be forced to go without an acceptable home, regardless of whether they are retired or not.

The second strategy should be to entirely remove the kind of zoning laws that have contributed to the kind of increase in housing prices seen today - mandating that only single family homes should be allowed to be built on massive lots with low utilization is hugely harmful to housing affordability.

These two measures would address housing prices having gone up in the way they have historically, which would also lead to property taxes not rising in such a dramatic fashion.

What should never be done, however, is reducing or capping property taxes.

You make it sound like it's either or. The resonable thing to do would be to reduce property taxes for the property the owner lives in and tax even more the additional properties. The goal is for people to be able to afford their homes and at the same time making properties not so attractive as an investment.

Please refer to the section about the negative effects of reducing property taxes.

Correct me if I'm wrong, but that applies to reducing property taxes as a whole. I'm talking about a mixed approach.

There's potential for mitigating some of the negative impacts using a mixed approach, although I'm not convinced it's going to be straightforward or even worthwhile.