GameStop Company Turnaround

Since 2021, GameStop has been undergoing a transformation: fewer stores, higher value, renewed profitability

By June 2021, Ryan Cohen and the new board of directors were in the position to initiate the turnaround of the company. This has involved extensive cutting of costs, closing of stores, and modernization of a company that had previously failed to adapt with the modern era.

"We inherited a bunch of legacy everything, and under-investment across the entire business –- people, the entire technology stack, just decades of neglect, and so it’s hard to turn around a brick and mortar retailer that’s under the kind of pressure that GameStop was and continues to be under, but that was also part of the attraction going into GameStop was that a transformation the likes of GameStop was really unprecedented and I was motivated by that." -- Ryan Cohen (November 2022)

GameStop has made substantial efforts to upgrade and modernize its online store and enhance its overall omnichannel experience. This has included investing in a more user-friendly and mobile-responsive website, streamlining the checkout process, and improving product availability and search functionality. Additionally, the company has integrated buy-online-pickup-in-store and same-day delivery options.

In September 2023, Ryan Cohen became the CEO of the company. In December 2023, the board approved a new investment policy which gave Ryan Cohen the authority to manage the company's investment portfolio.

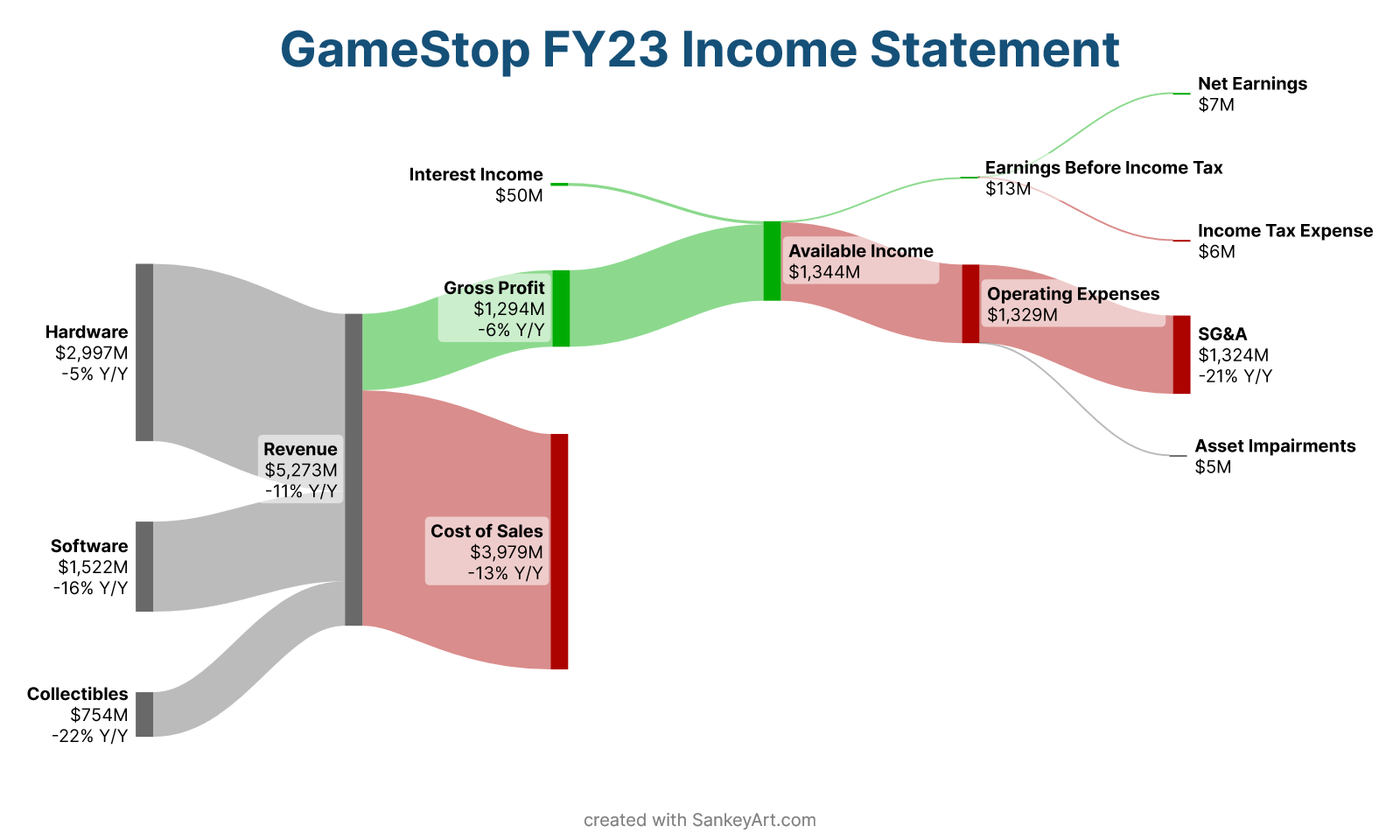

In March 2024, the company reported full-year profitability for the first time in 6 years.

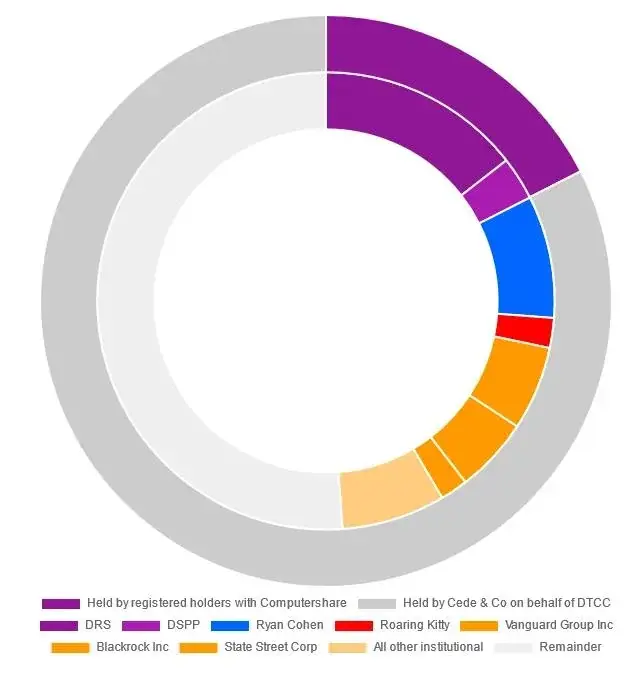

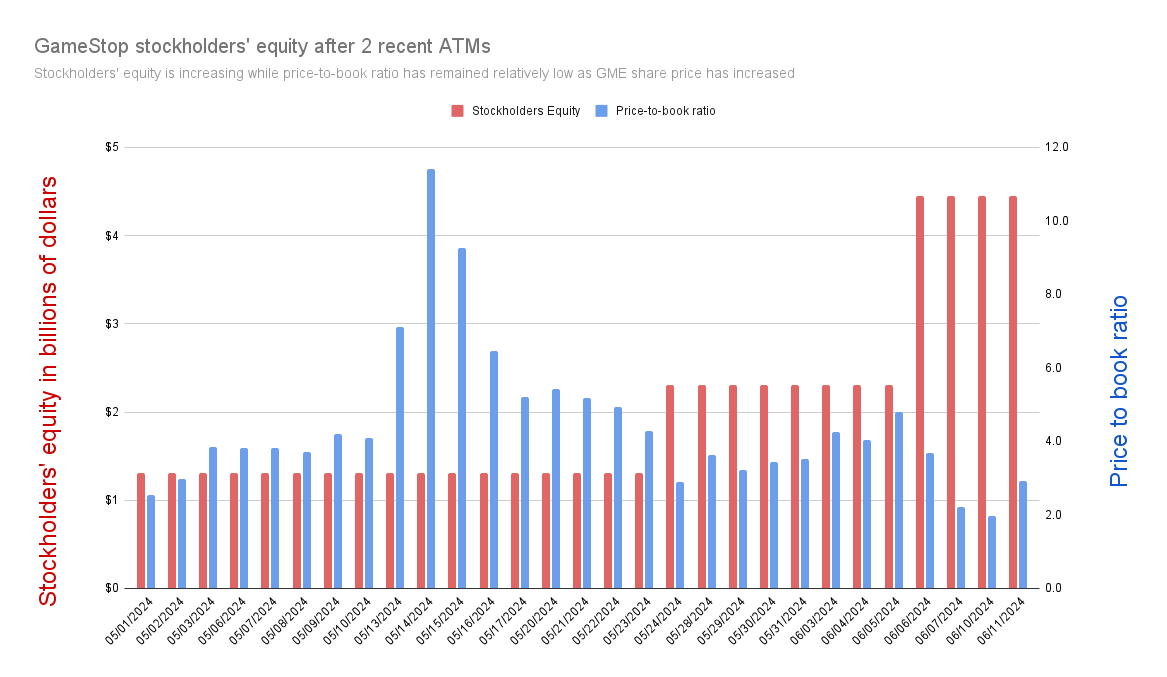

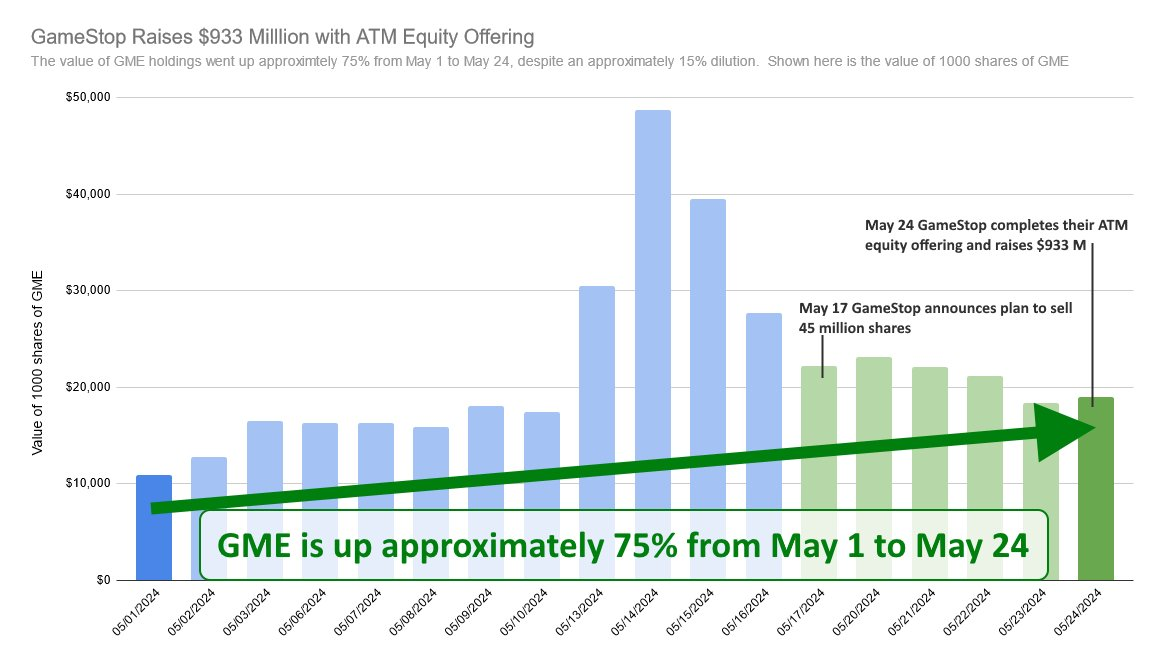

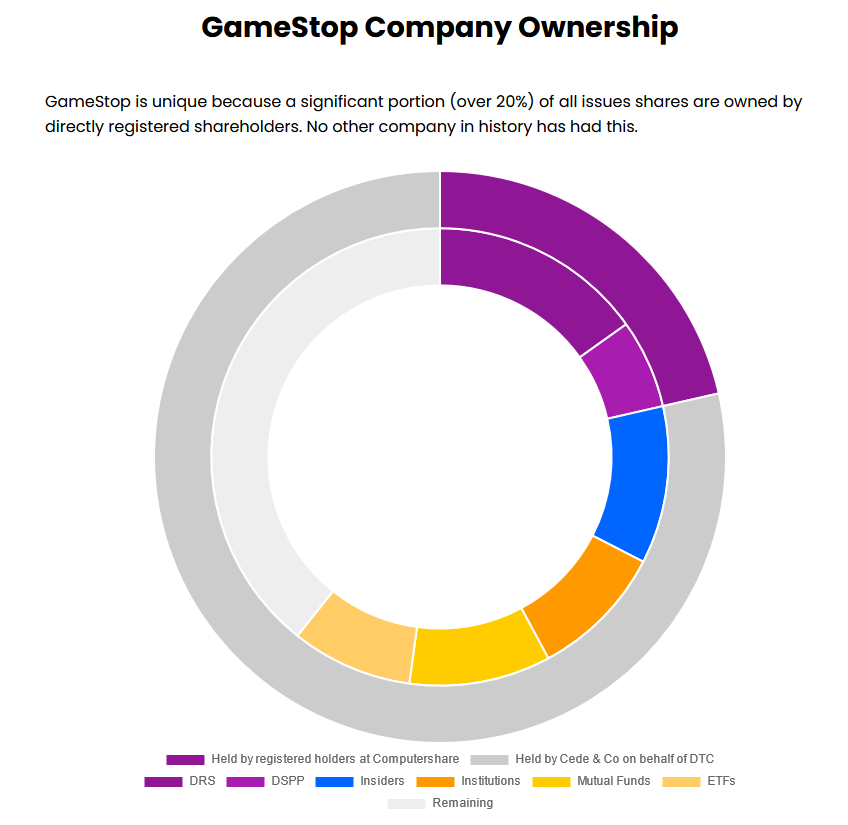

In 2024, the company completed 3 at-the-market equity offering programs, raising approximately $3.5 billion in cash, raising the book value per share of GME to nearly $11.

"with respect to retail operations, we plan to continue reducing costs and focusing on profitability... This means a smaller network of stores with an expanded assortment of higher value items that fit into our trade-in model." -- Ryan Cohen, 2024 annual shareholder meeting (June 17, 2024 )

In 2024, GameStop began selling new original products such as Candy con controllers and the Raptor 8 mobile gaming controller.

In addition to the release of new original products, GameStop has also expanded into the graded trading card market.

- On October 15, 2024, GameStop announced a collaboration with PSA, becoming an authorized PSA dealer, with PSA providing authentication and grading services for trading cards through select GameStop stores across the United States.

- On November 18, 2024, GameStop announced that Nat Turner, Chairman and CEO of Collectors Holdings, Inc., has been appointed to the Company’s Board of Directors.

The turnaround of GameStop has been in progress for about 3 and a half years, depending on when the precise start point is.

A look at the core financial metrics shows significant improvements to the financial standing of the company.

GameStop has raised cash and eliminated practically all of the debt that it had. Now holding a large pile of cash, the company earns interest income rather than paying interest on debts.

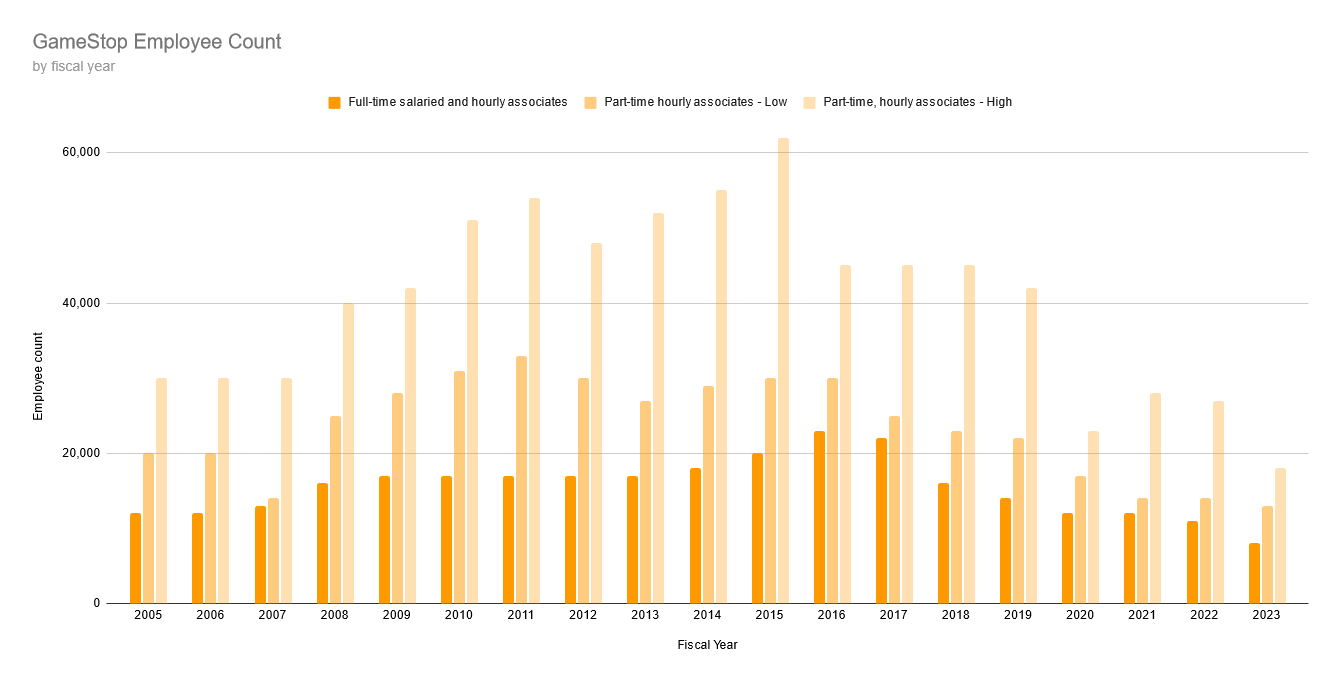

GameStop continues to close more stores every year, a trend that began before the initiation of the company turnaround. As GameStop closes more stores, the revenue continues to decrease, as does the SG&A expenses.

While operating income has seen significant improvement, it remains negative.

🤷

🫡