this post was submitted on 30 Mar 2024

845 points (97.2% liked)

Memes

11326 readers

408 users here now

Post memes here.

A meme is an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme.

An Internet meme or meme, is a cultural item that is spread via the Internet, often through social media platforms. The name is by the concept of memes proposed by Richard Dawkins in 1972. Internet memes can take various forms, such as images, videos, GIFs, and various other viral sensations.

- Wait at least 2 months before reposting

- No explicitly political content (about political figures, political events, elections and so on), !politicalmemes@lemmy.ca can be better place for that

- Use NSFW marking accordingly

Laittakaa meemejä tänne.

- Odota ainakin 2 kuukautta ennen meemin postaamista uudelleen

- Ei selkeän poliittista sisältöä (poliitikoista, poliittisista tapahtumista, vaaleista jne) parempi paikka esim. !politicalmemes@lemmy.ca

- Merkitse K18-sisältö tarpeen mukaan

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

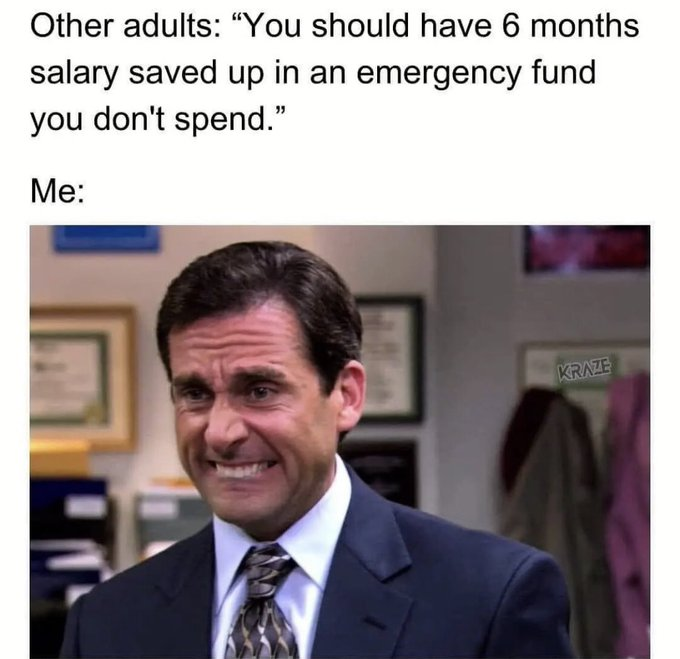

In what universe is this even possible for most people? Because it's not this one.

Its possible in this one, it just isn't easy, takes a while, and generally isnt super pleasant.

When people say to "live within your means", they don't mean "don't spend more than you make", they mean "save enough to maintain your financial security".

I was that person until mid 2019.

Then some unexpected huge home expenses vaporized the emergency savings.

Then COVID happened and I lost my job! TWICE! This was after being an engineer at the same company for 16 years. My shit was stable AF before it all started.

Now I’m a much happier person with a much better job, but my finances are LOLfukt. Fortunately due to me trying to be careful in the past, I already owned a small cheap home in a reasonable COL area, so I can’t complain.

Not really; you just found out why an emergency fund is important.

Oh I extracted the full potential of my rainy day preparedness, no doubt.

But the three things in that sentence still hold true. My finances are not fucked because of the better mental state and job, they’re just fucked all on their own due to recent history. But at least I can work on it now.

It is in this one. Unfortuanlty its not easy, and any medical event, car issue, house issue, or girlfriend can wreck that in a day.

If you stay home with your parents for a year or two, you'd get plenty of savings if you're careful. I know I did.

I know in more individualistic countries not moving out by 18 or 20s has traditionally been seen as taboo, but the current housing situation makes that traditional social rule very impractical for many. Besides, from what I heard in the USA, still living at home with parents is less stigmatised than before.

My savings where wiped out buying a house. Now it’s fucking impossible between maintenance and god knows whatever else is flung at me.

Moving out at a young age is only a norm in just a handful of countries, mainly the English speaking ones. Reason being that they were more developed than the rest of the world, making it possible for them to move out when they turn 18. Poverty is a big reason why families are closer and live together for a much longer period. But many of these developed nations seem to be regressing these days, with more money flowing upwards than downwards.

I agree though. The best time to move out is after you've worked and saved up enough for a down payment for your own place. Those few years are perhaps the best opportunity to save up that most of us may never get again.

It wasn't even really common in the US until the 70s-80s.

I have about $10k socked away into an HSA account from when I had a high deductible insurance plan. With an HSA you can leave the money in an investment account, you don't have to withdraw it when the cost occurs. You just need to have receipts for the amounts you withdraw so you can show them to the IRS is bed be. So I save all my receipts for doctors visits, prescriptions, OTC medicine, glasses, dental, and anything else allowed. Then I have tax free money sitting in an investment account that I can withdraw tax free if I have a real emergency.

You can also put money into a Roth IRA and you can withdraw your contributions tax free.

There's a bunch of ways to make your money work for you and still have access to it in a true emergency.

In any universe. Just stop wasting money for a change.

Lots of good reasons why someone might end up in debt. I got divorced and laid off. Dog needed $2k surgery to not have a terrible quality of life. Got a terrible staph infection on my chest after losing health insurance. This all happened in a four month period. I moved to a cheaper apartment, cut off any subscription aside from internet, which I need for two of my four jobs, got a cheaper phone plan, and mostly ate rice and beans every day. Still, it's taken a year just to get back to zero.

That's why it is important to build an emergency fund.