this post was submitted on 21 Feb 2024

30 points (58.6% liked)

General Discussion

13660 readers

1 users here now

Welcome to Lemmy.World General!

This is a community for general discussion where you can get your bearings in the fediverse. Discuss topics & ask questions that don't seem to fit in any other community, or don't have an active community yet.

🪆 About Lemmy World

🧭 Finding Communities

Feel free to ask here or over in: !lemmy411@lemmy.ca!

Also keep an eye on:

- !newcommunities@lemmy.world

- !communitypromo@lemmy.ca

- !new_communities@mander.xyz

- !communityspotlight@lemmy.world

- !wowthislemmyexists@lemmy.ca!

For more involved tools to find communities to join: check out Lemmyverse!

💬 Additional Discussion Focused Communities:

- !actual_discussion@lemmy.ca - Note this is for more serious discussions.

- !casualconversation@lemm.ee - The opposite of the above, for more laidback chat!

- !letstalkaboutgames@feddit.uk - Into video games? Here's a place to discuss them!

- !movies@lemm.ee - Watched a movie and wanna talk to others about it? Here's a place to do so!

- !politicaldiscussion@lemmy.world - Want to talk politics apart from political news? Here's a community for that!

Rules and Policies

Remember, Lemmy World rules also apply here.

0. See: Rules for Users.

- No bigotry: including racism, sexism, homophobia, transphobia, or xenophobia.

- Be respectful. Everyone should feel welcome here.

- Be thoughtful and helpful: even with ‘silly’ questions. The world won’t be made better by dismissive comments to others on Lemmy.

- Link posts should include some context/opinion in the body text when the title is unaltered, or be titled to encourage discussion.

- Posts concerning other instances' activity/decisions are better suited to !fediverse@lemmy.world or !lemmydrama@lemmy.world communities.

- No Ads/Spamming.

- No NSFW content.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

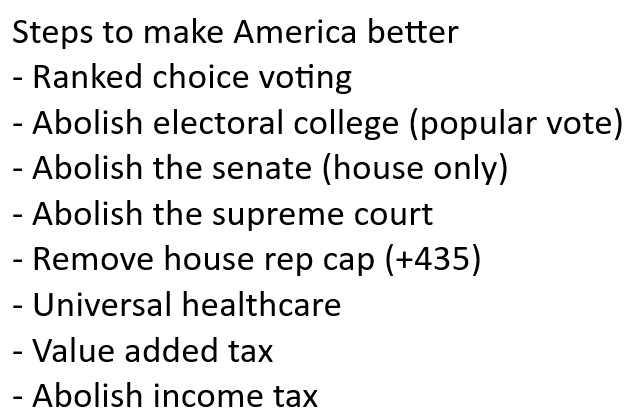

This is incredibly misleading. I thought propublica was better than this. They calculated these billionaires “true tax rates” based on unrealized gains. Until they cash out they don’t actually make the money.

You can argue for higher income tax brackets, or a more progressive capital gains ladder, or regulations in banking stopping rich people from using other peoples money based on equity they have or any number of way more complicated things that aren’t income related, but outside of just a wealth tax which is something entirely different, these true tax rate numbers are nonsense.

His idea that an income tax is super regressive because the wealthy can live off "unrealized gains" is wrong. But so is your assertion that they don't actually make money until they realize the gains.

Wealthy people live off of low interest loans that use their stock as collateral. However as long as the green line goes up, they never need to really worry. And when payment comes due it just gets rolled into another loan. The primary mistake the merely rich make when trying to move up is transitioning to this model too early or too aggressively and losing their stock collateral.

This is also how billionaires take a 1 dollar "paycheck" and afford to fly private jets everywhere. "Unrealized gains" is a lie and a giant loophole in our tax system.

I know, and that’s what I was vaguely describing. It’s something entirely different than what’s being talked about.