Memes

Post memes here.

A meme is an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme.

An Internet meme or meme, is a cultural item that is spread via the Internet, often through social media platforms. The name is by the concept of memes proposed by Richard Dawkins in 1972. Internet memes can take various forms, such as images, videos, GIFs, and various other viral sensations.

- Wait at least 2 months before reposting

- No explicitly political content (about political figures, political events, elections and so on), !politicalmemes@lemmy.ca can be better place for that

- Use NSFW marking accordingly

Laittakaa meemejä tänne.

- Odota ainakin 2 kuukautta ennen meemin postaamista uudelleen

- Ei selkeän poliittista sisältöä (poliitikoista, poliittisista tapahtumista, vaaleista jne) parempi paikka esim. !politicalmemes@lemmy.ca

- Merkitse K18-sisältö tarpeen mukaan

Start running a zero balance with a set amount. So if you ste your zero at $100. If you have $200 you only have 100. Raise this over time until you have enough

I think there is a whole lot of variability in this equation. I do try to keep some "cushion" in the bank, but I can borrow if I have to. So if I have drained the savings I can still get by via borrowing for a while if necessary.

I'm fortunate that my employment is very steady. The chances of me losing my job are slim. If it were less steady I'd be better about keeping that cash stashed.

If the unlikely did happen and I lost my job I would pretty quickly have access to a large stash of cash. Which I'd rather save but would spend if it saves my ass from starving and foreclosure.

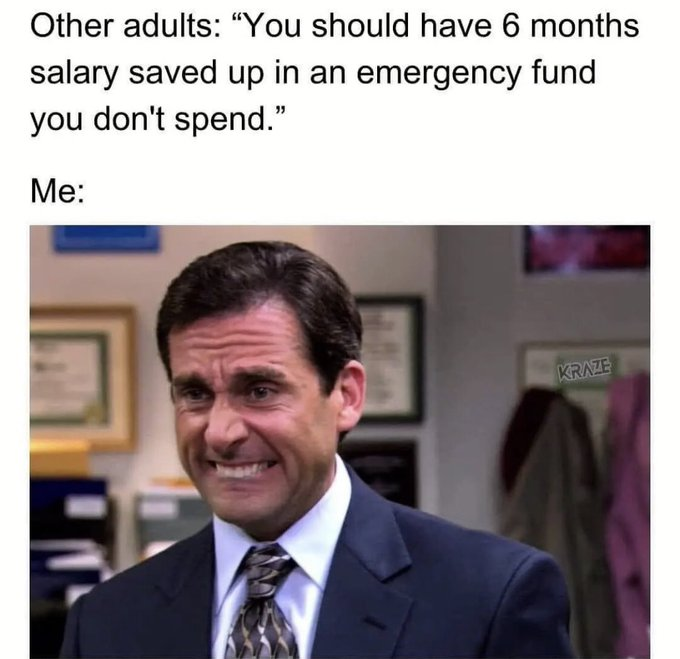

I don't have anything remotely close to 6 months savings in the bank. It doesn't make economic sense for me to do so. I'm far better off talking any would-be savings and put it towards all this debt I'm still carrying from my college days.

You will never make more interest on an investment than you will get charged interest for the same amount as a loan. Ever. It does not happen. So for me to sit on money that could go towards paying down debts, I'm just needlessly paying more in interest than I would be otherwise.

My current plan is to pay down or pay off all by debts (ultimately paying them off but if they're close then ok); then consolidate all of my remaining debt into a line of credit, and close out all of my other debt accounts. When that's paid, it will hopefully be enough that I can put that available credit towards any spontaneous costs, and if no such costs occur, save as much as I can so I won't need the line of credit if I have incidentals. Hopefully saving up to 6 months or more, plus investing into a retirement fund.

The retirement fund is an afterthought because at this point in my life I expect that I will be financially incapable of retiring. I'll just work until either I go crazy (dementia or similar), or I simply die at my job. I'll just work until I'm dead.

I've been so financially fucked by all the once-in-a-(insert large amount of time here) events that just coincidentally all happened during my life so far that this is what I'm expecting going forward. Record inflation, stagnant wages, everything as-a-service basically robbing you monthly for something you should have bought and long since paid off, but instead you're paying for in perpetuity for no good reason....

Everything has turned into a monthly charge. It's terrible, and you think "oh, it's only $20 a month". Yeah, that's $240/yr. For something that probably doesn't make you any money and probably doesn't help you with your employment or any earnings you may bring in... It's just a stupid tax. We're stupid.

You will never make more interest on an investment than you will get charged interest for the same amount as a loan. Ever. It does not happen.

This is barely more accurate than a coin flip. Until 2021, it wasn't that difficult to find loans with rates under 5%. Anything under 4% is basically free money and you're normally better off investing in something low risk than to pay extra.

So for me to sit on money that could go towards paying down debts, I'm just needlessly paying more in interest than I would be otherwise.

If you don't have any emergency funds, or not enough to cover a single large emergency, this is dumb. Cars break, roofs leak, etc. Even if you have an emergency where you can pay on credit, you'll likely be looking at credit card interest rates. Or, you lose your job. Fun fact, most job loses occur when the economy is struggling. Another fun fact, most investments are doing really fucking poorly when the economy is struggling.

Keep some money on hand in case something happens.

I have a bit of savings, but nowhere near 6 months worth. Just have had enough freak accidents and those "once-in-a-(insert large amount of time here)" events that having at least a month's worth of savings has saved me from taking out more debt enough times that I try to keep something saved.

That said, while I'm sure the interest I've spent on my debt over the years has been enormous, the one silver lining to it all is that with inflation, my debt feels more manageable than it did 10 years ago. Not that I can really afford pay it off that much faster since every other part of life is more expensive, but in comparison to everything else, it feels much less overwhelming than it used to.